If you were really concerned about losing national sovereignty, as the UK Leave campaign claims to be, then you would logically need to leave lots of other international organizations, not just the EC. The WTO, Inmarsat, the International Maritime Organization, Interpol, the International Criminal Court, even the International Cricket Conference all impose obligations on their members and compromise their sovereignty. What would British life be if the country were not in any of these organizations? Let us take just one example – The International Telecommunications Union, and it’s European analogue, ETSI. It it perfectly possible for a country to have its own mobile telephony standards – Japan and the Scandinavian bloc are past examples. But customer roaming between nations then becomes difficult, and costs of every component part will be higher, due to a loss of scale economies. Even just operating a common mobile standard but at a different frequencies limits roaming, as anyone alive in the 1990s and traveling between the USA and Europe will recall.

Archive for the ‘Telecommunications’ Category

Page 0 of 2

Bill Mansfield RIP

A belated tribute to Bill Mansfield (1942-2011), Australian trade unionist, ACTU official and Industrial Relations Commission judge, who died earlier this year. Elected federal secretary of the Australian Telecommunications Employees Association (ATEA), the main union of technical telecommunications staff, at a young age in 1977, Mansfield was one of a generation of Australian union leaders who were progressive, modern, reasonable, anti-Luddite, and very intelligent. I had the good fortune to meet him and to hear him speak on several occasions, once at a seminar on the drivers and consequences of technological change; it was clear that most managements would be out-smarted by him, and many foiled by his integrity, his willingness to engage in reasoned argument, and his integrity-of-purpose. In the 1970s, the ATEA and its fellow communications unions ran a long-running and ultimately successful campaign seeking to get the management of Telstra (as the organization is now called) merely to have discussions with the unions about new technologies, their impacts, and their deployment; it was indicative of the belligerent stupidity of the management of the time that they sought to introduce new technologies without prior discussion with the affected workforce because management feared the workforce would be opposed.

There are tributes to him from his ACTU colleagues here and from Senator Doug Cameron here.

Markets as feedback mechanisms

I just posted after hearing a talk by economic journalist Tim Harford at LSE. At the end of that post, I linked to a critical review of Harford’s latest book, Adapt – Why Success Always Starts with Failure, by Whimsley. This review quotes Harford talking about markets as feedback mechanisms:

To identify successful strategies, Harford argues that “we should not try to design a better world. We should make better feedback loops” (140) so that failures can be identified and successes capitalized on. Harford just asserts that “a market provides a short, strong feedback loop” (141), because “If one cafe is ordering a better combination of service, range of food, prices, decor, coffee blend, and so on, then more customers will congregate there than at the cafe next door“, but everyday small-scale examples like this have little to do with markets for credit default swaps or with any other large-scale operation.

Yes, indeed. The lead-time between undertaking initial business planning in order to raise early capital investments and the launching of services to the public for global satellite communications networks is in the order of 10 years (since satellites, satellite networks and user devices need to be designed, manufactured, approved by regulators, deployed, and connected before they can provide service). The time between initial business planning and the final decommissioning of an international gas or oil pipeline is about 50 years. The time between initial business planning and the final decommissioning of an international undersea telecommunications cable may be as long as 100 years. As I remarked once previously, the design of Transmission Control Protocol (TCP) packets, the primary engine of communication in the 21st century Internet, is closely modeled on the design of telegrams first sent in the middle of the 19th century. Some markets, if they work at all, only work over the long run, but as Keynes famously said, in the long run we are all dead.

I have experience of trying to design telecoms services for satellite networks (among others), knowing that any accurate feedback for design decisions may come late or not at all, and when it comes may be vague and ambiguous, or even misleading. Moreover, the success or failure of the selected marketing strategy may not ever be clear, since its success may depend on the quality of execution of the strategy, so that it may be impossible to determine what precisely led to the outcome. I have talked about this issue before, both regarding military strategies and regarding complex decisions in general. If the quality of execution also influences success (as it does), then just who or what is the market giving feedback to?

In other words, these coffees are not always short and strong (in Harford’s words), but may be cold, weak, very very slow in arriving, and even their very nature contested. I’ve not yet read Harford’s book, but if he thinks all business is as simple as providing fmc (fast-moving consumer) services, his book is not worth reading.

Once again, an economist argues by anecdote and example. And once again, I wonder at the world: That economists have a reputation for talking about reality, when most of them evidently know so little about it, or reduce its messy complexities to homilies based on the operation of suburban coffee shops.

The long after-life of design decisions

Reading Natasha Vargas-Cooper’s lively romp through the 1960s culture referenced in the TV series Mad Men, I came across Tim Siedell’s discussion of a witty, early 1960s advert by Doyle Dane Bernbach for Western Union telegrams, displayed here.

Seeing a telegram for the first time in about, oh, 35 years*, I looked at the structure. Note the header, with information about the company, as well as meta-information about the message. That structure immediately brought to mind the structure of a TCP packet.

The Transmission Control Protocol (TCP) is the work-horse protocol of the Internet, and was developed by Vince Cerf and Bob Kahn in 1974. Their division of the packet contents into a header-part (the control information) and a data part (the payload) no doubt derived from earlier work on the design of packets for packet-switched networks. Later packets (eg, for IP, the Internet Protocol) were simpler, but still retained this two-part structure. This two-part division is also found in voice telecommunications at the time, for example in Common Channel Signalling Systems, which separated message content from information about the message (control information). Such systems were adopted internationally by the ITU for voice communications from Signalling System #6 (SS6) in 1975 onwards. In case the packet design seems obvious, it is worth considering some alternatives: the meta-information could be in a footer rather than in a header, or enmeshed in the data itself (as, for example, HTML tags are enmeshed in the content they modify). Or, the meta-data could be sent in a separate packet, perhaps ahead of the data packet, as happens with control information in Signalling System #7 (SS7), adopted from 1980. There are technical reasons why some of these design possibilities are not feasible or not elegant, and perhaps the same reasons apply to transmission of telegrams (which is, after all, a communications medium using packets).

The first commercial electrical telegraph networks date from 1837, and the Western Union company itself dates from 1855 (although created from the merger of earlier companies). I don’t know when the two-part structure for telegrams was adopted, but it was certainly long before Vannevar Bush predicted the Internet in 1945, and long before packet-switched communications networks were first conceived in the early 1960s. It is interesting that the two-part structure of the telegramlives on in the structure of internet packets.

* Footnote: As I recall, I sent my first email in 1979.

Reference:

Tim Siedell [2010]: “Western Union: What makes a great ad?” pp. 15-17 of: Natasha Vargas-Cooper [2010]: Mad Men Unbuttoned. New York, NY: HarperCollins.

Metrosexual competition

Writing about the macho world of pure mathematics (at least, in my experience, in analysis and group theory, less so in category theory and number theory, for example), led me to think that some academic disciplines seem hyper-competitive: physics, philosophy, and mainstream economics come to mind. A problem for economics is that the domain of the discipline includes the study of competition, and the macho, hyper-competitive nature of academic economists has led them, I believe, astray in their thinking about the marketplace competition they claim to be studying. They have assumed that their own nasty, bullying, dog-eat-dog world is a good model for the world of business.

If business were truly the self-interested, take-no-prisoners world of competition described in economics textbooks and assumed in mainstream economics, our lives would all be very different. Fortunately, our world is mostly not like this. One example is in telecommunications where companies compete and collaborate with each other at the same time, and often through the same business units. For instance, British Telecommunications and Vodafone are competitors (both directly in the same product categories and indirectly through partial substitutes such as fixed and mobile services), and collaborators, through the legally-required and commercially-sensible inter-connections of their respective networks. Indeed, for many years, each company was the other company’s largest customer, since the inter-connection of their networks means each company completes calls that originate on the other’s network; thus each company receives payments from the other.

Do you seek to drive your main competitor out of business when that competitor is also your largest customer? Would you do this, as stupid as it seems, knowing that your competitor could retaliate (perhaps pre-emptively!) by disconnecting your network or reducing the quality of your calls that interconnect? No rational business manager would do this, although perhaps an economist might.

Nor would you destroy your competitors when you and they are sharing physical infrastructure – co-locating switches in each other’s buildings, for example, or sharing rural cellular base stations, both of which are common in telecommunications. And, to complicate matters, large corporate customers of telecommunications companies increasingly want direct access to the telco’s own switches, leading to very porous boundaries between companies and their suppliers. Doctrines of nuclear warfare, such as mutually-assured destruction or iterated prisoners’ dilemma, are better models for this marketplace than the mainstream one-shot utility-maximizing models, in my opinion.

You might protest that telecommunications is a special case, since the product is a networked good – that is, one where a customer’s utility from a particular service may depend on the numbers of other customers also using the service. However, even for non-networked goods, the fact that business usually involves repeated interactions with the same group of people (and is decidely not a one-shot interaction) leads to more co-operation than is found in an economist’s philosophy.

The empirical studies of hedge funds undertaken by sociologist Donald MacKenzie, for example, showed the great extent to which hedge fund managers rely in their investment decisions on information they receive from their competitors. Because everyone hopes to come to work tomorrow and the day after, as well as today, there are strong incentives on people not to mis-use these networks through, for instance, disseminating false or explicitly-self-serving information.

It’s a dog-help-dog world out there!

Reference:

Iain Hardie and Donald MacKenzie [2007]: Assembling an economic actor: the agencement of a hedge fund. The Sociological Review, 55 (1): 57-80.

The future is not what it was

The Internet, as imagined in 1969, complete with free sexism. (Hat tip: SW).

Brand immortality

Catching up with films I missed when they first appeared, I have just watched that action-spy thriller of the almost-over Cold War, Little Nikita, which first appeared in 1988.

The story was fairly predictable, and the most exciting moment for me occurred at minute 77, when two of the protagonists, trying to flee San Diego for Mexico, turned a corner on which was located a NYNEX Business Center. These were a nationwide chain of 80 retail computer hardware and services outlets most of which NYNEX bought from IBM in 1986 (according to rumour, after a handshake over an inter-CEO game of golf), and then sold in 1991 to Computerland. When NYNEX owned them, they comprised the third-largest non-franchise network of retail computer outlets in the US.

One of the seven Baby Bells (aka RBOCs) created by the break up of the Bell System in 1984, NYNEX was the only one to pursue an adult career as an IT services company, at one point earning sufficient revenues from software and related services to be placed in the Top-10 largest US software companies. For all the synergies, however, telecommunications and software development are sufficiently different businesses, and/or NYNEX senior managers cared insufficiently for these differences, that NYNEX never appeared to take seriously their role as a software company. Having cured itself of its untypical desire to be a leading software house by re-selling most of its purchases in this sector, NYNEX, a few mergers later, has now become Verizon.

It is nice to think that, in centuries to come, the NYNEX Business Centers brand will live on in the moving pictures.

Complexity of communications

Recently, I posted about probability theory, and mentioned its modern founder, Andrei Kolmogorov. In addition to formalizing probability theory, Kolmogorov also defined an influential approach to assessing the complexity of something.

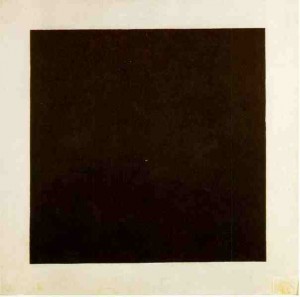

He reasoned that a more complex object should be harder to create or to re-create than a simpler object, and so you could “measure” the degree of complexity of an object by looking at the simplest computer program needed to generate it. Thus, in the most famous example used by complexity scientists, the 1915 painting called “Black Square” of Kazimir Malevich, is allegedly very simple, since we could recreate it with a very simply computer program:

Paint the colour black on every pixel until the surface is covered, say.

But Kolmogorov’s approach ignores entirely the context of the actions needed to create the object. Just because an action is simple or easily described, does not make it easy to do, or even easy to decide to do. Art objects, like most human artefacts, are created with deliberate intent by specific creators, as anthropologist Alfred Gell argued in his theory of art. To understand a work of art (or indeed any human artefact) we need to assess its effects on the audience in the light of its creator’s intended effects, which means we need to consider the intentions, explicit or implicit, of its creators. To understand these intentions in turn requires us to consider the context of its creation, what a philosopher of language might call its felicity conditions.

Malevich’s Black Sqare can’t be understood, in any sense, without understanding why no artist before him created such a painting. There is no physical or technical reason that Rembrandt, say, or Turner, could not have painted a canvas consisting only of one colour, black. But they did not, and could not have, and could not even have imagined doing so. (Perhaps only the 18th-century Welsh painter Thomas Jones could have imagined doing so, with his subtle paintings of near-monochrome Neapolitan walls.) It is not a coincidence that Malevich’s painting appeared in the historical moment when it did, and not anytime before nor anyplace else. For instance, Malevich worked at a time when educated people were fascinated with notions of a fourth or even further dimensions, and Malevich himself actively tried to represent these other dimensions in his art. To imagine that such a painting could be adequately described without reference to any art-historical background, or socio-political context, or the history of ideas is to confuse the syntax of the painting with its semantics and pragmatics. We understand nothing about the painting if all we understand is that every pixel is colored black.

We have been here before. The mathematical theory of communications of Claude Shannon and Warren Weaver has been very influential in the design of the physical layers of telecommunications and computer communications networks. But this theory explicitly ignores the semantics – the meanings – of messages. (To be fair to Shannon and Weaver they do tell us explicitly early on that they will be ignoring the semantics of messages.) Their theory is therefore of no use to anyone interested in communications at layers above the physical transmission of signals, that is, anyone interested in understanding or using communication to communicate with other people or machines.

References:

M. Dabrowski [1992]: “Malevich and Mondrian: nonobjective form as the expression of the “absolute”. ” pp. 145-168, in: G. H. Roman and V. H. Marquardt (Editors): The Avant-Garde Frontier: Russia Meets the West, 1910-1930. Gainesville, FL, USA: University Press of Florida.

Alfred Gell [1998]: Art and Agency: An Anthropological Theory. Oxford, UK: Clarendon Press.

L. D. Henderson [1983]: The Fourth Dimension and Non-Euclidean Geometry in Modern Art. Princeton, NJ, USA: Princeton University Press.

Claude E. Shannon and Warren Weaver [1963]: The Mathematical Theory of Communication. Chicago, IL, USA: University of Illinois Press.

Extreme teams

Eric Nehrlich, over at Unrepentant Generalist, has reminded me of the book “The Wisdom of Teams“, by Jon Katzenbach and Douglas Smith, which I first read when it appeared in the early 1990s. At the time, several of us here were managing applications for major foreign telecommunications licences for our clients – the fifth P (“Permission”) in telecoms marketing.

Before Governments around the world realized what enormous sums of money they could make from auctioning telecoms licences, they typically ran what was called a “beauty contest” to decide the winner. In these contests, bidders needed to prepare an application document to persuade the Government that they (the bidder) were the best company to be awarded the licence. What counted as compelling arguments differed from one country to another, and from one licence application to another. The most common assessment criteria used by Governments were: corporate reputation and size, technical preparedness and innovation, quality of business plans, market size and market growth, and the prospects for local employment and economic development.

As I’m sure you see immediately, these criteria are multi-disciplinary. Licence applications were (and still are, even when conducted as auctions) always a multi-disciplinary effort, with folks from marketing, finance, engineering, operations, legal and regulatory, folks from different consortium partners, and people from different nationalities, all assigned to the one project team. In the largest application we managed, the team comprised an average of about 100 people at any one time (people came and went all the time), and it ran for some 8 months. In that case, the Government tender documents required us to prepare about 7,000 original pages of text in response (including detailed business plans and blue-prints of each mobile base station), multiplied by some 20 copies. You don’t win these licences handing in coffee-stained photocopies or roneoed sheets. Each of the 20 volumes was printed on glossy paper, hard-bound, and the lot assembled in a carved tea chest.

Work on these team projects was extremely challenging, not least because of the stakes involved. If you miss the application submission deadline even by 5 minutes, you were out of the running. That would mean throwing away the $10-20 million you spent preparing the application and upsetting your consortium partners more than somewhat. If you submit on time, and you win the licence, you might see your company’s share-market value rise by several hundred million dollars overnight, simply on the news that you had a won a major overseas mobile licence. $300 million sharevalue gain less $20 million preparation costs leaves a lot of gain. In one case, our client’s share-market value even rose dramatically on news that they had LOST the licence! We never discovered if this was because the shareholders were pleased that the company (not previously in telecoms) had lost and was sticking to its knitting, or were pleased that the company had tried to move into a hi-tech arena.

With high stakes, an unmovable deadline, and with different disciplines and companies involved, tempers were often loose. One of the major differences between our experiences and those described in the Katzenbach and Smith book is that we never got to choose the team members. In almost all cases, Governments required consortia to comprise a mix of local and international companies, so each consortium partner would choose its own representatives in the team. Sometimes, the people assigned knew about the telecoms business and had experience in doing licence applications; more frequently, they knew little and had no relevant experience. In addition, within each consortium partner company, internally powerful people in the different disciplines would select which folks to send. One could sometimes gauge the opinion of the senior managers of our chances by the calibre of the people they chose to allocate to the team.

So — our teams comprised people having different languages, national cultures and corporate cultures, from different disciplines and having different skillsets and levels of ability, and sent to us sometimes for very different purposes. (Not everyone, even within the same company, wanted to win each licence application.) Did I mention we normally had no line authority over anyone since they worked for different divisions of different companies? Our task was to organize the planning work of these folks in a systematic and coherent way to produce a document that looked like it was written by a single mind, with a single, coherent narrative thread and compelling pitch to the Government evaluators.

Let us see how these characteristics stack up against the guidelines of Katzenbach and Smith, which Eric summarized:

Despite not matching these guidelines, some of the licence application teams were very successful, both in undertaking effective high-quality collaborative work and in winning licences. I therefore came away from reading “The Wisdom of Teams” 15 years ago with the feeling that the authors had missed something essential about team projects because they had not described my experiences in licence applications. (I even wrote to the authors at the time a long letter about my experiences, but they did not deign to reply.) I still feel that the book misses much.

The future is bright, the future is sepia!

The results of a competition to produce vintage advertisement for modern products can be found here. The best entry is an advertisement for Mr Nokia’s Patent Mobile Telephonic Communicator and Typographic Messenger with Box-Brownie J-PEG Maker and MP3 Gramophone, circa 1900, which plays on the slogan of British mobile operator, Orange, now part of France Telecom.