Karl Marx was correct, it seems, in predicting that capitalism would suffer recurring crises. What he seems to have overlooked is the impact of his own predictions (with companies and governments taking steps to eliminate or ameliorate the worst effects of the system), and capitalism’s adaptability. With the socialization of the means of exchange taking place in much of the western world this month, capitalism has shown that it is even willing to adopt its own antithesis in order to survive.

Author Archive for peter

Page 83 of 85

Viral marketing

The International Herald Tribune carried an article about viral marketing and counter-viral marketing in US Presidential races last week. The attackers and defenders have been at this game for a couple of centuries, only the technologies have changed.

Complexity of communications

Recently, I posted about probability theory, and mentioned its modern founder, Andrei Kolmogorov. In addition to formalizing probability theory, Kolmogorov also defined an influential approach to assessing the complexity of something.

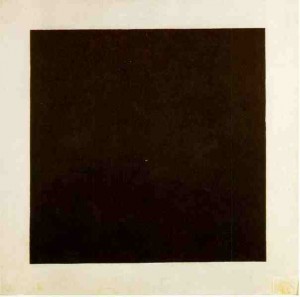

He reasoned that a more complex object should be harder to create or to re-create than a simpler object, and so you could “measure” the degree of complexity of an object by looking at the simplest computer program needed to generate it. Thus, in the most famous example used by complexity scientists, the 1915 painting called “Black Square” of Kazimir Malevich, is allegedly very simple, since we could recreate it with a very simply computer program:

Paint the colour black on every pixel until the surface is covered, say.

But Kolmogorov’s approach ignores entirely the context of the actions needed to create the object. Just because an action is simple or easily described, does not make it easy to do, or even easy to decide to do. Art objects, like most human artefacts, are created with deliberate intent by specific creators, as anthropologist Alfred Gell argued in his theory of art. To understand a work of art (or indeed any human artefact) we need to assess its effects on the audience in the light of its creator’s intended effects, which means we need to consider the intentions, explicit or implicit, of its creators. To understand these intentions in turn requires us to consider the context of its creation, what a philosopher of language might call its felicity conditions.

Malevich’s Black Sqare can’t be understood, in any sense, without understanding why no artist before him created such a painting. There is no physical or technical reason that Rembrandt, say, or Turner, could not have painted a canvas consisting only of one colour, black. But they did not, and could not have, and could not even have imagined doing so. (Perhaps only the 18th-century Welsh painter Thomas Jones could have imagined doing so, with his subtle paintings of near-monochrome Neapolitan walls.) It is not a coincidence that Malevich’s painting appeared in the historical moment when it did, and not anytime before nor anyplace else. For instance, Malevich worked at a time when educated people were fascinated with notions of a fourth or even further dimensions, and Malevich himself actively tried to represent these other dimensions in his art. To imagine that such a painting could be adequately described without reference to any art-historical background, or socio-political context, or the history of ideas is to confuse the syntax of the painting with its semantics and pragmatics. We understand nothing about the painting if all we understand is that every pixel is colored black.

We have been here before. The mathematical theory of communications of Claude Shannon and Warren Weaver has been very influential in the design of the physical layers of telecommunications and computer communications networks. But this theory explicitly ignores the semantics – the meanings – of messages. (To be fair to Shannon and Weaver they do tell us explicitly early on that they will be ignoring the semantics of messages.) Their theory is therefore of no use to anyone interested in communications at layers above the physical transmission of signals, that is, anyone interested in understanding or using communication to communicate with other people or machines.

References:

M. Dabrowski [1992]: “Malevich and Mondrian: nonobjective form as the expression of the “absolute”. ” pp. 145-168, in: G. H. Roman and V. H. Marquardt (Editors): The Avant-Garde Frontier: Russia Meets the West, 1910-1930. Gainesville, FL, USA: University Press of Florida.

Alfred Gell [1998]: Art and Agency: An Anthropological Theory. Oxford, UK: Clarendon Press.

L. D. Henderson [1983]: The Fourth Dimension and Non-Euclidean Geometry in Modern Art. Princeton, NJ, USA: Princeton University Press.

Claude E. Shannon and Warren Weaver [1963]: The Mathematical Theory of Communication. Chicago, IL, USA: University of Illinois Press.

Knit one, purl one

A key problem for forecasting demand for new products is that people keep thinking up new uses for technologies. Who would have thought, for example, that mobile phones could be used by knitters.

How to manage creatives (not)

Managing creative talent is always difficult, but locking artists in battery farms seems somewhat extreme.

Putting the "Tea" in IT

One of the key ideas in the marketing of high-tech products is due to Eric von Hippel of the MIT Sloan School, the idea that lead users often anticipate applications of new technologies before the market as a whole, and even before inventors and suppliers. This is because lead users have pressing or important problems for which they seek solutions, and turn to whatever technologies they can find to respond to their problems.

A good example is shown by the history of Information Technology. The company which pioneered business applications of the new computer technology in the early 1950s was not a computer hardware manufacturer nor even an electronic engineering firm, but a lead user, Lyons Tea Shops, a nationwide British chain of tea-and-cake shops. Lyons specified, designed, built, deployed and operated their own computers, under the name of Leo (Lyons Electronic Office). Lyons, through Leo, was also the first to conceive and deploy many of the business applications which we now take for granted, such as automated payroll systems and logistics management systems. One of the leaders in that effort, David Caminer, has recently died at the age of 92. LEO was later part of ICL, itself later purchased by Fujitsu.

This post is intended to honour David Caminer, as a pioneer of automated business decision-making.

Putting the "Tea" in IT

One of the key ideas in the marketing of high-tech products is due to Eric von Hippel of the MIT Sloan School, the idea that lead users often anticipate applications of new technologies before the market as a whole, and even before inventors and suppliers. This is because [tag]lead users[/tag] have pressing or important problems for which they seek solutions, and turn to whatever technologies they can find to respond to their problems.

A good example is shown by the history of Information Technology. The company which pioneered business applications of the new computer technology in the early 1950s was not a computer hardware manufacturer nor even an electronic engineering firm, but a lead user, Lyons Tea Shops, a nationwide British chain of tea-and-cake shops. [tag]Lyons[/tag] specified, designed, built, deployed and operated their own computers, under the name of Leo (Lyons Electronic Office). Lyons, through [tag]Leo[/tag], was also the first to conceive and deploy many of the business applications which we now take for granted, such as automated payroll systems and logistics management systems. One of the leaders in that effort, David Caminer, has recently died at the age of 92. LEO was later part of ICL, itself later purchased by Fujitsu.

This post is intended to honour David Caminer, as a pioneer of [tag]automated business decision-making[/tag].

Banking on Linda

Over at “This Blog Sits”, Grant McCracken has a nice post about a paradigm example often used in mainstream economics to chastise everyday human reasoners. A nice discussion has developed. I thought to re-post one of my comments, which I do here:

“The first point — which should be obvious to anyone who deals professionally with probability, but often seems not — is that the answer to a problem involving uncertainty depends very crucially on its mathematical formulation. We are given a situation expressed in ordinary English words and asked to use it to make a judgment. The probability theorists have arrived at a way of translating such situations from natural human language into a formal mathematical language, and using this formalism, to arrive at an answer to the situation which they deem correct. However, natural language may be imprecise (as in the example, as gek notes). Imprecision of natural language is a key reason for attempting a translation into a formal language, since doing so can clarify what is vague or ambiguous. But imprecision also means that there may be more than one reasonable translation of the same problem situation, even if we all agreed on what formal language to use and on how to do the translation. There may in fact be more than one correct answer.

There is much of background relevance here that may not be known to everyone, First, note that it took about 250 years from the first mathematical formulations of uncertainty using probability (in the 1660s) to reach a sort-of consensus on a set of mathematical axioms for probability theory (the standard axioms, due to Andrei Kolmogorov, in the 1920s). By contrast, the differential calculus, invented about the same time as Probability in the 17th century, was already rigorously formalized (using epsilon-delta arguments) by the mid-19th century. Dealing formally with uncertainty is hard, and intuitions differ greatly, even for the mathematically adept.

Second, even now, the Kolmogorov axioms are not uncontested. Although it often comes as a surprise to statisticians and mathematicians, there is a whole community of intelligent, mathematically-adept people in Artificial Intelligence who prefer to use alternative formalisms to probability theory, at least for some problem domains. These alternatives (such as Dempster-Shafer theory and possibility theory) are preferred to probability theory because they are more expressive (more situations can be adequately represented) and because they are easier to manipulate for some types of problems than probability theory. Let no one believe, then, that probability theory is accepted by every mathematically-adept expert who works with uncertainty.

Historical aside: In fact, ever since the 1660s, there has been a consistent minority of people dissenting from the standard view of probability theory, a minority which has mostly been erased from the textbooks. Typically, these dissidents have tried unsuccessfully to apply probability theory to real-world problems, such as those encountered by judges and juries (eg, Leibniz in the 17th century), doctors (eg, von Kries in the 19th), business investors (eg, Shackle in the 20th), and now intelligent computer systems (since the 1970s). One can have an entire university education in mathematical statistics, as I did, and never hear mention of this dissenting stream. A science that was confident of its own foundations would surely not need to suppress alternative views.

Third, intelligent, expert, mathematically-adept people who work with uncertainty do not even yet agree on what the notion of “probability” means, or to what it may validly apply. Donald Gillies, a professor of philosophy at the University of London, wrote a nice book, Philosophical Theories of Probability, which outlines the main alternative interpretations. A key difference of opinion concerns the scope of probability expressions (eg, over which types of natural language statements may one validly apply the translation mechanism). Note that Gillies wrote his book 70-some years after Kolmogorov’s axioms. In addition, there are other social or cultural factors, usually ignored by mathematically-adept experts, which may inform one’s interpretations of uncertainty and probability. A view that the universe is deterministic, or that one’s spiritual fate is pre-determined before birth, may be inconsistent with any of these interpretations of uncertainty, for instance. I have yet to see a Taoist theory of uncertainty, but I am sure it would differ from anything developed so far.

I write this comment to give some context to our discussion. Mainstream economists and statisticians are fond of castigating ordinary people for being confused or for acting irrationally when faced with situations involving uncertainty, merely because the judgements of ordinary people do not always conform to the Kolmogorov axioms and the deductive consequences of these axioms. It is surely unreasonable to cast such aspersions when experts themselves disagree on what probability is, to what statements probabilities may be validly applied, and on how uncertainty should be formally represented.

Reference:

Donald Gillies [2000]: Philosophical Theories of Probability. (London, UK: Routledge)

Macro-economic models

The New Zealand-born economist, Bill Phillips, is best known for identifying an empirical relationship between a country’s inflation rate and its unemployment, the so-called Phillips curve. However, before becoming an economist, Phillips had been an engineer, and in 1949 he built one of the first models of a national economy, the MONIAC. MONIAC used flows of coloured water to represent money flows through an economy, and perhaps explains (or is a reflection of) traditional economics’ obsession with distinguishing stocks from flows.

In the 1970s, the Australian cartoonist Bruce Petty also built a physical model of a national economy, but this time with seats for several human operators, representing variously The Government, The Unions, Big Business, etc. Instead of the hydraulic flows used by Phillips, Petty’s model used mechanical levers and pulleys, which impacted in convoluted ways on the machine and on the other operators. This model looked something built by Heath Robinson or Rube Goldberg, and was immense fun to watch it at work. I’ve not yet been able to find a video of Petty’s model at work.

A cosmopolite in a cafe

One of O. Henry’s short stories has a character who refuses to say where he is from:

“I’ve been around the world twelve times,” said he. “I know an Esquimau in Upernavik who sends to Cincinatti for his neckties, and I saw a goat-herder in Uruguay who won a prize in a Battle Creek breakfast food puzzle competition. I pay rent on a room in Cairo, Egypt, and another in Yokohoma all the year round. I’ve got slippers waiting for me in a tea-house in Shanghai, and I don’t have to tell ’em how to cook my eggs in Rio Janeiro [sic] or Seattle. It’s a mighty little old world. What’s the use of bragging about being from the North, or the South, or the old manor house in the dale, or Euclid Avenue, Cleveland, or Pike’s Peak, or Fairfax County, Va., or Hooligan’s Flats or anyplace? It’ll be a better world when we quit being fools about some mildewed town or ten acres of swampland just because we happened to be born there.”

Of course, this being an O. Henry story, the guy later gets into a fight because someone criticizes Mattawamkeag, Maine, the dorp where the guy is actually from!

O. Henry: “A cosmopolite in a cafe”, pp. 11-15, The Four Million. The Complete Works of O. Henry, Volume 1. (Garden City, NY: Doubleday, 1953.)